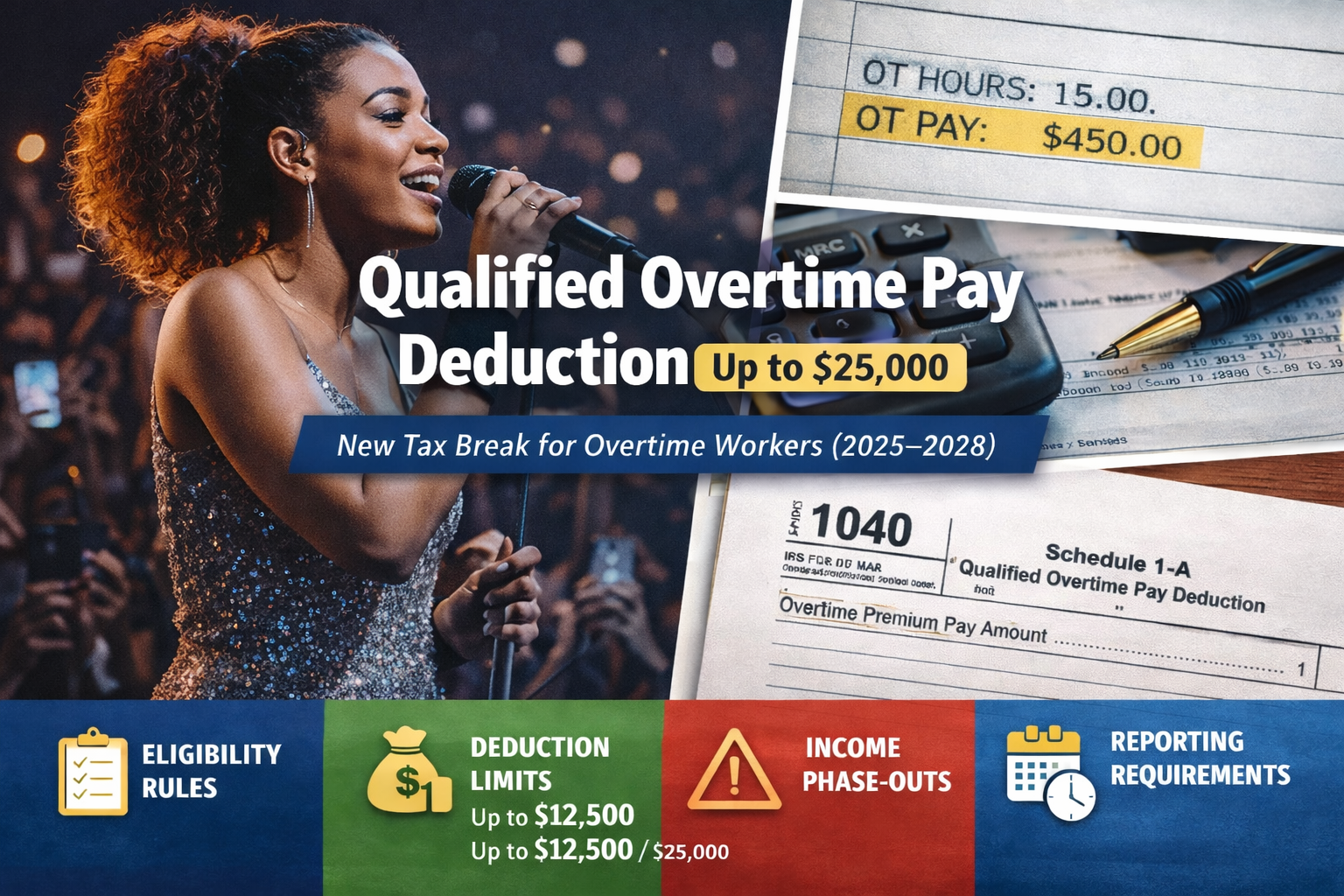

Deduct up to $25k in overtime pay

What You Need to Know

If you’re an hourly employee who regularly earns overtime pay — such as healthcare workers, first responders, construction workers, hospitality employees, manufacturing staff, or other non-exempt workers — this new federal deduction may reduce your taxable income beginning in 2025.

Below, Samir explains how to determine whether you qualify, how the deduction is calculated, and what planning steps to take now.

Eligibility for the Deduction - You must meet specific requirements based on federal overtime law. Here's a breakdown:

You must receive overtime compensation required under the Fair Labor Standards Act.

Only the premium portion of overtime qualifies (i.e., the extra “one-half” above your regular rate).

Supervisors and other exempt salaried employees who are not legally entitled to overtime typically do not qualify.

The deduction applies to tax years 2025 through 2028.

-

Up to $12,500 per year (Single filers)

Up to $25,000 per year (Married Filing Jointly)

*Importantly, this is not the full overtime paycheck — only the premium portion counts toward the cap.

-

Description The deduction phases out once Modified Adjusted Gross Income exceeds:

$150,000 (Single)

$300,000 (Married Filing Jointly)

Above these thresholds, the allowable deduction gradually decreases.

-

The deduction reduces federal taxable income — it does not change payroll withholding during the year.

The deduction will be claimed on a schedule attached to your Form 1040.

Proper classification of employees remains essential; misclassification could eliminate eligibility.